Master Your Money: Proven Steps to Finally Start Saving

Introduction

Have you ever felt the crushing weight of financial stress? The endless cycle of bills, debt, and unexpected expenses can leave anyone feeling hopeless. But it doesn’t have to be this way. Mastering your finances is not just about numbers; it’s about reclaiming your peace of mind, security, and future. This article will guide you through proven steps to take control of your money, start saving effectively, and create a brighter financial future.

Understanding Your Financial Situation

Self-Assessment: The First Step to Freedom

Before you can start saving, it’s crucial to understand where you stand financially. Take a moment to assess your income, expenses, and debts. Write it all down; sometimes seeing the numbers can be a wake-up call.

Interactive Element: Use a simple worksheet or calculator to input your financial data. This will help you visualize your current situation.

Emotional Appeal: Knowing your financial health is the first step toward alleviating stress. Imagine the relief of no longer being in the dark about your finances. It’s empowering to take control!

Setting Clear Goals

The Importance of Financial Goals

Once you understand your current situation, the next step is to set clear financial goals. Think about what you want to achieve—whether it’s saving for a vacation, buying a home, or preparing for retirement.

SMART Goals: A Framework for Success

Use the SMART criteria to define your goals:

- Specific: What exactly do you want to save for?

- Measurable: How much do you need to save?

- Achievable: Is your goal realistic?

- Relevant: Does it matter to you?

- Time-bound: When do you want to achieve this goal?

Interactive Element: Fill out a SMART goals template to clarify your objectives.

Emotional Angle: Visualizing your dreams can be a powerful motivator. Saving money is not just about numbers; it’s about achieving what you truly desire.

Creating a Budget That Works

Different Budgeting Methods

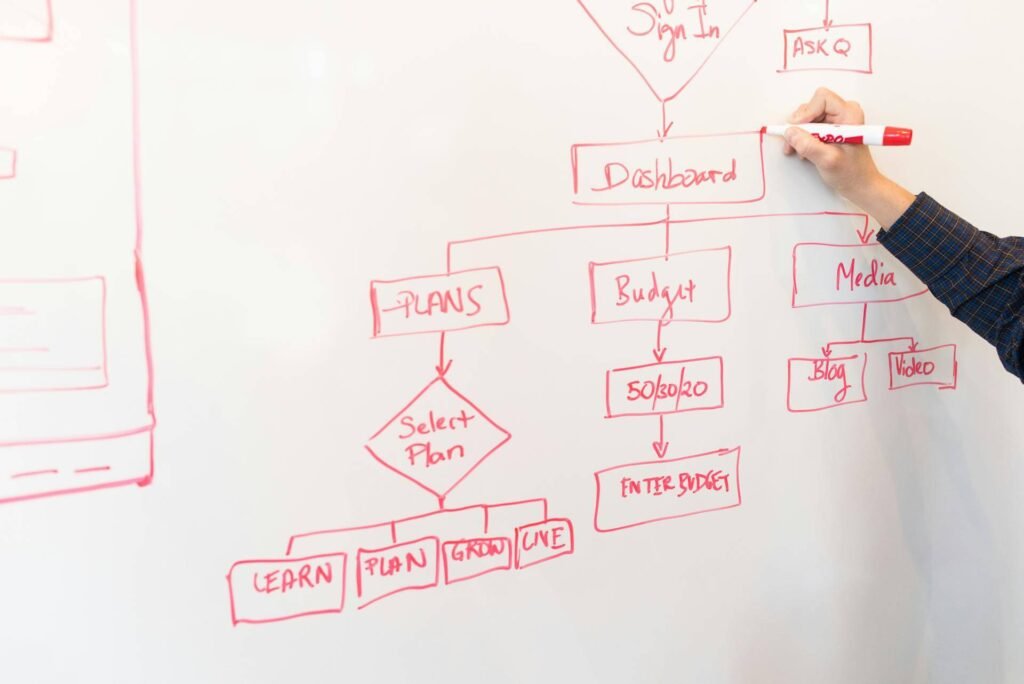

Budgeting is your roadmap to financial success. There are various methods you can choose from:

- Zero-Based Budget: Every dollar you earn is allocated to specific expenses.

- 50/30/20 Rule: 50% of your income goes to needs, 30% to wants, and 20% to savings.

Step-by-Step Budget Creation

- Track Your Income: Know exactly how much you make each month.

- List Your Expenses: Categorize your spending (fixed and variable).

- Adjust as Needed: Identify areas where you can cut back.

Interactive Element: Download a budgeting template to simplify the process.

Emotional Connection: Many people have transformed their lives through budgeting. Think of it as a way to regain control and reduce financial anxiety.

Building an Emergency Fund

Why You Need a Safety Net

Life is unpredictable. An emergency fund acts as a financial cushion for unexpected expenses like medical bills or car repairs.

How Much Should You Save?

Aim to save 3-6 months’ worth of living expenses. Start small—even $500 can make a significant difference.

Tips for Building Your Fund

- Automate Your Savings: Set up automatic transfers to your savings account.

- Start with Small, Manageable Goals: Aim for $500 first, then build from there.

Interactive Element: Use a savings tracker to monitor your progress.

Emotional Appeal: Imagine facing an unexpected expense without panic. An emergency fund gives you peace of mind and security.

Cutting Unnecessary Expenses

Evaluate Your Spending Habits

Review your monthly expenses critically. Are there subscriptions you don’t use? Can you reduce dining out?

Practical Tips to Cut Costs

- Cancel Unused Subscriptions: Evaluate which services you really need.

- Plan Your Meals: Cooking at home can save you a substantial amount.

- Shop Smart: Use coupons, buy in bulk, and compare prices.

Interactive Element: Create a checklist for evaluating subscriptions and memberships.

Emotional Resonance: Real-life success stories can inspire you. Many have saved hundreds simply by changing their habits, resulting in newfound financial freedom.

Finding Additional Income Streams

Explore Side Hustles

Consider finding additional income through side hustles. This could include freelance work, part-time jobs, or even selling handmade crafts online.

Invest in Skills

Enhance your employability by taking courses or attending workshops. Skills in high demand can significantly boost your income potential.

Interactive Element: List platforms where you can find freelance work or online courses to improve your skills.

Emotional Connection: Stories of people who transformed their financial situations through extra income show that hard work pays off. The empowerment of earning extra money can be life-changing.

Staying Motivated and Accountable

Finding Support

Having a support system is crucial for staying on track. Share your goals with friends, family, or online communities for encouragement.

Celebrate Milestones

Set small milestones along the way to your main goal and celebrate your successes. This will keep you motivated.

Interactive Element: Create a progress tracker to visualize your journey and celebrate small wins.

Emotional Note: Remember that mastering your finances is a journey. It’s okay to have setbacks; perseverance is key to achieving your goals.

Sure! Here’s a conclusion and summary for your article that maintains an interactive, attractive, and emotional tone.

Conclusion

Congratulations! You’ve taken the first crucial steps toward mastering your money and paving the way for a financially secure future. Remember, this journey is not just about numbers; it’s about crafting a life filled with freedom, peace of mind, and the ability to pursue your dreams. As you implement these strategies—setting clear goals, creating a budget, building an emergency fund, cutting unnecessary expenses, and seeking additional income—you are actively shaping a brighter tomorrow.

Now, take a moment to reflect on your journey. What goals are you most excited about? What small victories have you already celebrated? Embrace the process, knowing that every step, no matter how small, brings you closer to your financial aspirations. Share your goals with friends or family, or join an online community to stay motivated and accountable. You’re not alone in this journey—many have walked this path and have emerged stronger and more empowered.

Call to Action: Challenge yourself today! Set aside just 15 minutes to write down one financial goal you want to achieve in the next month. Post it somewhere visible, and commit to taking at least one action towards it each week. Remember, your future self is cheering you on!

Summary

In “Master Your Money: Proven Steps to Finally Start Saving,” we explored a comprehensive approach to take control of your finances and start saving effectively.

- Understanding Your Financial Situation: A self-assessment is the first step in taking charge of your money.

- Setting Clear Goals: Establish SMART goals that will motivate you to save.

- Creating a Budget: Learn different budgeting methods to map out your income and expenses effectively.

- Building an Emergency Fund: Create a safety net to cushion unexpected expenses and bring peace of mind.

- Cutting Unnecessary Expenses: Identify areas where you can save without sacrificing your quality of life.

- Finding Additional Income Streams: Explore side hustles and skill development to increase your earnings.

- Staying Motivated and Accountable: Engage with a support system and celebrate milestones to maintain your momentum.

By following these steps, you’re not just saving money; you’re investing in your future and taking control of your life. So, embark on this journey with courage and determination. The road to financial mastery is ahead of you, and every step counts toward achieving the freedom you desire.

FREQUENTLY ASKED QUESTIONS(FAQs)

1. Why is it important to understand my financial situation before saving?

Understanding your financial situation is like taking a health check-up before starting a fitness program. It gives you clarity on where you stand financially, allowing you to identify your strengths and weaknesses. Imagine the relief of knowing exactly how much you earn, spend, and owe—this clarity empowers you to make informed decisions that align with your goals!

2. How do I stay motivated to stick to my budget?

Staying motivated can feel challenging, but think of budgeting as a tool that helps you create the life you desire. Celebrate your small victories, like sticking to your budget for a week or saving a little extra! Share your goals with friends or join an online community. Their support will help keep you accountable, reminding you that you’re not alone on this journey.

3. What if I don’t have enough money to start an emergency fund?

Starting small is key! Even saving just $5 a week can add up over time. Picture this: each dollar saved is a step towards peace of mind, knowing you have a safety net for life’s unexpected challenges. Remember, it’s about progress, not perfection. Your future self will thank you for every little effort you make today!

4. How can I identify unnecessary expenses in my budget?

Take a moment to review your spending habits. Are there subscriptions you rarely use? Or dining out more than you planned? Make it a fun challenge! Try a “no-spend week” where you focus on essentials only. Reflect on how liberating it feels to cut back. Each dollar saved is a step closer to achieving your financial goals!

5. What are some good side hustles I can start today?

The options are endless! Think about your skills or hobbies. Can you write, design, or teach? Consider freelancing, pet sitting, or selling handmade crafts online. Imagine the joy of earning extra money doing something you love! Each side hustle is not just extra income; it’s a step towards greater financial freedom.

6. How do I ensure I don’t fall back into bad financial habits?

It’s all about creating systems that support your new habits. Set reminders for bill payments, track your spending weekly, and review your budget monthly. Visualize your financial goals—what does financial freedom look like for you? Keep that vision alive, and surround yourself with supportive people who encourage your journey!

7. What’s the first step I should take after reading this article?

Take action! Grab a notebook or your favorite app and jot down one financial goal you want to achieve in the next month. Post it somewhere you’ll see it every day. Every journey begins with a single step, and by committing to just one goal, you’re already on your way to mastering your money!

8. How do I balance saving money with enjoying life?

Finding balance is crucial! It’s okay to indulge occasionally; think of it as rewarding yourself for your hard work. Consider creating a “fun fund” within your budget—set aside a specific amount each month for entertainment or splurges. This way, you can enjoy life while still making progress toward your savings goals. Picture this: enjoying a night out without guilt, knowing you’re also investing in your future!

9. What if my income fluctuates each month?

Income fluctuations can be challenging, but they also provide a great opportunity to learn how to manage your finances wisely. Focus on creating a budget based on your lowest monthly income. During better months, consider saving the extra for leaner times ahead. Imagine the security that comes from being prepared—like having a financial umbrella ready for unexpected rainy days!

10. How can I keep track of my expenses effectively?

Tracking expenses doesn’t have to be tedious! Use apps like Mint or YNAB (You Need A Budget) to simplify the process. You can also use a simple spreadsheet or even a pen-and-paper journal if that feels more comfortable. Picture yourself enjoying the satisfaction of watching your spending habits transform. Each entry is a step toward greater financial awareness and control!

11. How do I deal with debt while trying to save?

Dealing with debt can feel overwhelming, but remember: you’re not alone, and every little bit counts. Start by prioritizing high-interest debt while also setting aside a small amount for savings each month. This dual approach helps you tackle your debt while building a safety net. Visualize the day when you’ll be debt-free; every payment brings you closer to that moment of liberation!

12. Is it better to save for retirement or build an emergency fund first?

Both are important, but it’s often recommended to focus on building a small emergency fund first—think of it as your safety net. Aim for at least $1,000 before directing more funds to retirement accounts. Once you have that cushion, you can start contributing to retirement savings. Imagine the peace of mind that comes from knowing you’re preparing for both immediate and future needs!

13. How can I teach my children about money management?

Start early! Involve them in simple budgeting activities, give them an allowance, and encourage saving for a goal. Use real-life examples, like discussing family expenses or savings goals. Make it fun—play games that teach financial principles! Imagine the pride of seeing your children grow into financially savvy adults, equipped with the skills to navigate their own journeys!

14. What if I’ve made financial mistakes in the past?

Everyone makes mistakes; it’s a part of the learning process! The key is to reflect on what went wrong, learn from it, and move forward. Remember, your past doesn’t define your future. Picture each mistake as a stepping stone on your path to financial mastery. Acknowledge it, learn from it, and let it fuel your determination to do better!

15. How do I avoid financial burnout?

It’s essential to practice self-care on your financial journey. Set realistic goals, celebrate your progress, and don’t be too hard on yourself during setbacks. Take breaks when needed, and remind yourself that financial mastery is a marathon, not a sprint. Imagine the joy of achieving your goals at your own pace—each step taken with purpose and care.

16. Can I still enjoy spontaneous purchases while saving?

Absolutely! Spontaneity can be part of a balanced financial life. Set aside a designated amount each month for spontaneous purchases or fun activities. This way, you can enjoy the moment without derailing your financial goals. Picture the joy of treating yourself without guilt, knowing you’ve budgeted for it!

17. How can I overcome the fear of budgeting?

Budgeting can feel intimidating, but it’s a powerful tool that brings freedom! Start by viewing it as a way to empower yourself rather than restrict your spending. Begin with a simple budget—track your essential expenses and gradually expand. Imagine the sense of control you’ll feel as you take charge of your finances. Each small step you take builds confidence!

18. What if I’m living paycheck to paycheck?

Living paycheck to paycheck can be challenging, but there are ways to create a buffer. Focus on identifying and reducing non-essential expenses. Even saving small amounts can lead to a more stable financial situation over time. Picture yourself breaking free from the cycle, slowly building a safety net that gives you more flexibility and peace of mind.

19. How do I know if I’m saving enough?

Determining how much to save can depend on your personal goals and circumstances. As a general rule, aim to save at least 20% of your income. Additionally, evaluate your short-term and long-term goals. Imagine the security you’ll feel knowing you’re not just saving, but building a robust financial future!

20. What are some common budgeting mistakes to avoid?

Common mistakes include underestimating expenses, neglecting irregular costs (like car maintenance), and failing to adjust your budget as your situation changes. Keep a flexible mindset; life happens, and your budget should adapt! Picture your budget as a living document—something you refine over time to reflect your financial reality.

21. How can I teach my teenagers about money management?

Engaging your teens in financial discussions is vital! Give them an allowance to manage and encourage them to save for their own goals, like a new phone or concert tickets. Use real-world scenarios, like comparing prices while shopping. Imagine the pride of watching them grow into responsible adults who understand the value of money!